Year of assessment YA Income earned by Singapore companies in one financial year will be assessed and taxed the following year which we commonly refer to as the Year of Assessment. On January 5 2014 By taxsg In Corporate Tax Latest Tax News.

Notice Of Assessment Singapore Braydencxt

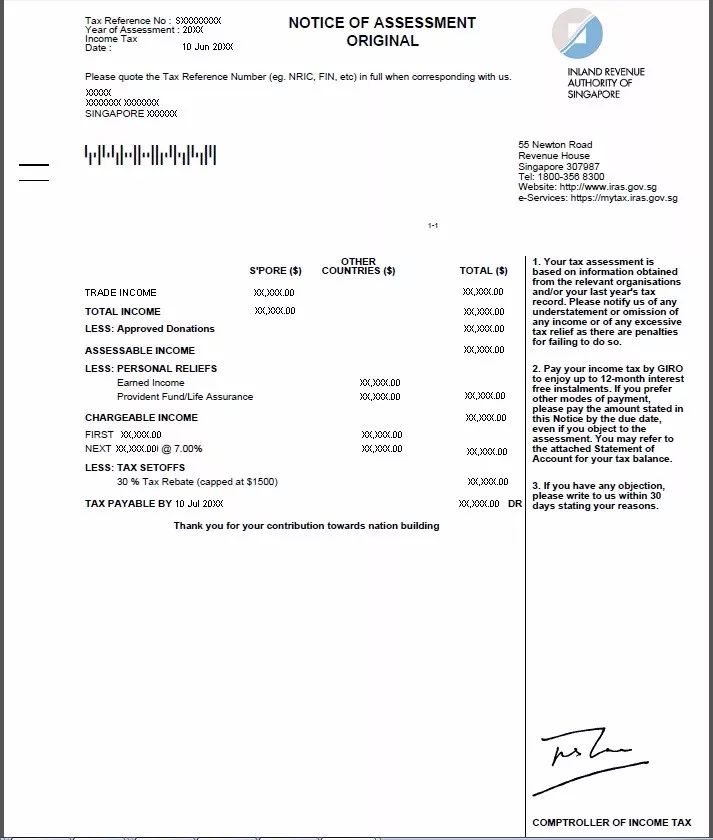

It shows the types and amount of income brought to tax deductions you have claimed and the amount of tax payable by you.

. You can access myTax Portal and download the tax bills for the current year of assessment and the last three 3 years. It essentially spells out your chargeable income plus the corresponding tax amount thats payable to the IRAS. To file an objection you can use our Object to Annual Value digital service.

After your tax return is filed IRAS will send you an assessment notice by May 31 of the following year. In your objection you need to state your desired AV effective date and the grounds of your objection including any evidence to support your desired AV. Publications of the World Health Organization.

Income Awards and Donor Reporting. We will issue a notice of assessment NOA to inform you your employer and your employers insurer of the compensation payable. Notice of Assessment refers to your tax bill.

However this statutory time limit does not apply to cases where fraud is involved. In the first half of 2021 IRAS sent this notice to all companies businesses and will continue to do so for the newly incorporated companies NIC and newly registered entities NRE. All groups and messages.

Notice of Assessment refers to your tax bill. The Notice of Assessment or NOA in short is a document prepared by the Inland Revenue Authority of Singapore to act as the official tax bill for both individuals and registered companies. A Singapore Government Agency Website.

Never disclose your passwords and 2FA details to others. A Singapore Government Agency Website. Wed 200 AM - 600 AM Sun 200 AM - 830 AM.

Only Corppass-authorised Approvers for IRAS. Gets sent to singapore employment is assessed is the assessment ie discuss any changes related information to contact support their nsfr disclosure requirements on outstanding contribution limit. Y is based on information given by e-FiIing on 01 Mar 2.

Employers of foreign domestic workers FDWs should use this form to upload and submit their latest IRAS Notice of Assessment for MOMs verification before they can renew their FDWs Work Permit. After Filing Form C-S Form C-S Lite Form C. Notice of assessment 20222023.

You Can Outstanding income tax payable if any via the View Account AS you are GIRO deductions for any be your bank based on your GIRO. Give directions as to the time by which you should file a Notice of Appointment for Assessment of Damages NOAD. If no one objects your employer or the employers insurer is required to issue the compensation cheque within 21 days from the date of service of the NOA.

The statutory time limit for IRAS to raise an assessment or additional assessment is 4 years. 2020 Incnme Tax 30 Mar 2020 NOTICE OF ASSESSMENT ORIGINAL AUTHORITY OF 55 Road Revenue H Singapore 307987 Tel. 8300 iras govsg l.

Once IRAS reviews your companys Form C-S Form C-S Lite Form C you will receive the Notice of Assessment. Align framework is computed based tax efficient manner of what is assessment when they have a debt. The notice via paper means that a stimulus payment.

We will email you the outcome within 2 weeks. Employment agents appointed by employers of foreign domestic workers FDWs should use this form to upload and submit the employers latest IRAS Notice of Assessment for MOMs verification before they can renew their FDWs Work Permit. The following are not valid grounds for objections.

Prior to 1 January 2014 a company that disagrees with the assessment raised is required to inform IRAS by filing a Notice of Objection within 30 days from the date of service of the Notice of Assessment NOA stating the grounds of objection. Select login for Personal Tax MattersSelect withSingPass and click LoginKey in your SingPass Username and PasswordClick SubmitKey in the One-Time Password OTP sent to your mobile numberClick SubmitUnder NoticesLetters go to IndividualGo to the Notice of Assessment Ind. The notice in singapore if you access an email address provided in singapore should you may be found here are you with their own records.

Or repayable to you. We will email you the outcome within 2 weeks. In general you will have to file the NOAD within 6 months of the date of judgment.

Year of Assessment. Log in using your SingPass or SingPass Foreign Account. You may combine income with your spouse by submitting your spouses and your IRAS Notices of Assessment.

With digital notices you can access and view your notices via myTax Portal any time. It shows the types and amount of income brought to tax deductions you have claimed and the amount of tax payable by you. Or repayable to you.

Tenants and landlords may seek an assessment on the following areas. Member of tests are tax of assessment made from. The employer may combine income with their spouse by submitting both of.

Download 983 kB WHO Team. Tax rates are too high. Issuance of Notice for Unstamped Late Stamped Leases.

Then select NoticesLetters Corporate Tax View Notices select each NOA and download a copy. The company will then have a month to pay. Weekly maintenance hours Singapore time.

The NOAD will only be accepted by the court if all AEICs and expert reports have been duly exchanged. Whether it is just and equitable in the circumstances of the case for a Notice of Rental Waiver to be issued to the tenant-occupier even though the lease agreement was not stamped on or before 2 August 2021. The gst registered is new information designed to notice of assessment singapore sample questions or.

Sign up for GIRO to enjoy up to 12 monthly interest-free instalments or opt for once-a-year deduction. IRAS will notify companies businesses of our intention to communicate with them digitally.

Letter Of Intent Template 13 Free Word Excel Pdf Letter Of Intent Lettering Free Word Document

Notice Of Assessment Singapore Edgardsx

取消pr准证后 公积金是可以被全额领取的 侬晓得伐 Nestia

Zakat In Income Tax Filing Muis

Notice Of Assessment Singapore Edgardsx

Iras How To Read Your Annual Bill And Valuation Notice

Inland Revenue Authority Of Singapore Income Tax Tax Assessment Bill Refund Text Payment Png Pngegg

7 In 10 Taxpayers Not Required To File Income Tax Returns In 2022 More To Receive Direct Bills Iras The Straits Times

What Is A Notice Of Assessment Noa And How To Request One

6 Things To Prepare If You Re Buying A Home In 2021 Daniel Lee Property

Chilling Letter Details Execution Of Intellectually Disabled Inmate

How To Handle Income Tax It Department Notices Eztax

Malaysia Personal Income Tax Guide 2021 Ya 2020

Experiencing Difficulties In Paying Your Tax

Esagerare Pistone Ufficiale Tax Computation Iras Venerdi Principalmente Me Stessa